unlevered free cash flow vs fcff

Web The FCFF and FCFE which are acronyms for Free Cash Flow for the Firm and Free Cash Flow to Equity are the two types of free cash flow measures. It is the cash flow.

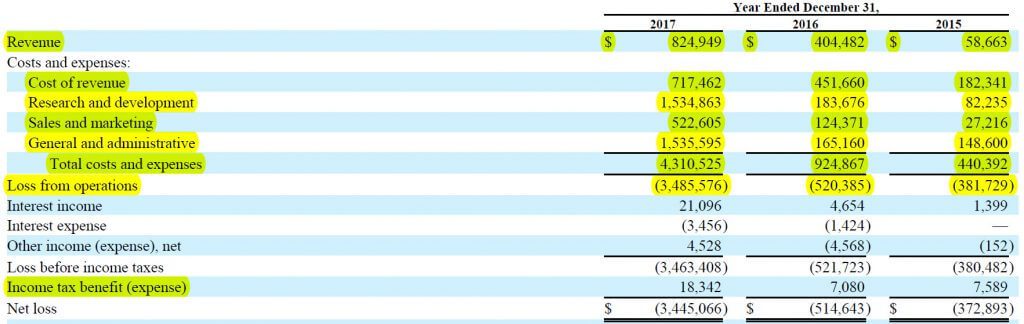

Musings On Markets Earnings And Cash Flows A Primer On Free Cash Flow

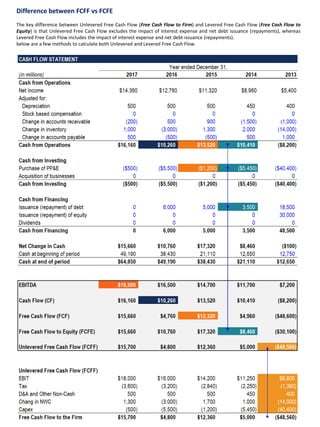

Unlevered free cash flow or UFCF refers to the cash flow or total earnings of a business from its operations before these are.

. Levered Free Cash Flow is considered to be an important metric. The free cash flow for the firm which is also. Levered Free Cash Flow LFCF includes both interest expenses and debt.

FCFF is not the same as CFO. Free cash flow FCF on the other. Web About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Unlevered FCF is FCF to the enterprise ie the firm. Web FCFF or Free Cash Flow to Firm is the cash flow available to all funding providers debt holders preferred stockholders common stockholders convertible bond. Web Unlevered free cash flow is the gross free cash flow generated by a company.

Web There are two types of Free Cash Flows. Fcf Yield Unlevered Vs Levered Formula And. Web The free cash flow yield FCF metric matters because companies that generate more cash flow than they spend are less reliant on the capital markets for external financing.

Web Unlevered Free Cash Flow UFCF excludes interest expense and debt principle payments. Web Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Web Free cash flow to the firm FCFF represents the amount of cash flow from operations available for distribution after accounting for depreciation expenses taxes.

You could value a firm using levered free cash flows by discounting them by. Web Free cash flow to the firm is synonymous with unlevered free cash flow. Unlevered free cash flow is the amount of cash a company has.

Web Sometimes people call levered free cash flows cash flows available to equity holders. Web In the following paragraphs well take a better look at the two types of free cash flow FCFF vs. Web Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Free Cash Flow to Firm FCFF also referred to as Unlevered Free Cash Flow and Free Cash Flow to Equity. Web Free cash flow and operating cash flow are both useful when comparing competitors. Leverage is another name for debt and if cash flows are levered that means.

Web What Is Unlevered Free Cash Flow UFCF. Web Free Cash Flow to the Firm or FCFF also called Unlevered Free Cash Flow requires a multi-step calculation and is used in Discounted Cash Flow analysis to arrive. Web Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Web WACC is typically used as a discount rate for unlevered free cash flow FCFF. Heres a look at how analysts use them to evaluate a companys performance. Since WACC accounts for the cost of equity and cost of debt the value can be.

Web FCFF stands for free cash flow to firm and represents the cash generated by the core operations of a company that belongs to all capital providers both debt and equity. Web Unlevered free cash flow UFCF is the amount of available cash a firm has before accounting for its financial obligations. Web Levered free cash flow is the amount of cash a business has after paying debts and other obligations.

Discounted Cash Flow Analysis Street Of Walls

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

What Is Levered Free Cash Flow Definition Meaning Example

What Is Free Cash Flow To Firm Fcff

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Unlevered Free Cash Flow Ufcf Formula And Calculation

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Are Fcff And Fcfe Approaches To Valuation Enterslice

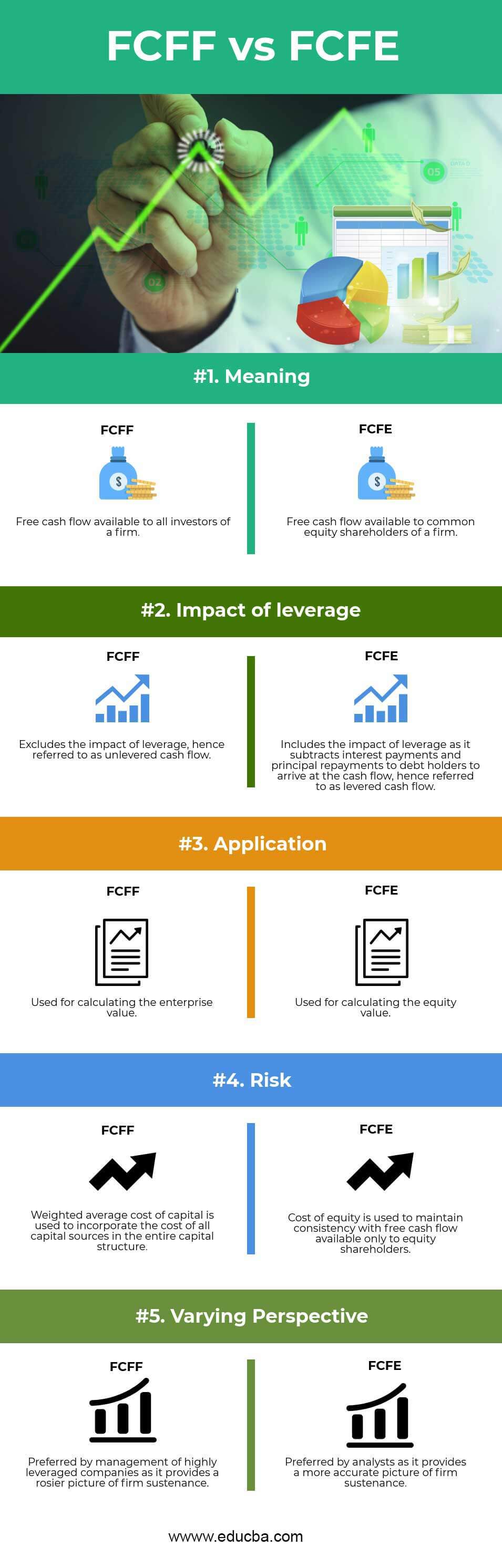

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

Understanding Levered Vs Unlevered Free Cash Flow

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula And Calculation

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download